msme loan process, how to apply for msme loan, msme loan calculator

Micro, Small, and Medium Enterprises (MSMEs) are a significant part of the Indian economy. These businesses generate employment, account for 45% of the country’s manufacturing output, and contribute 8% to the national GDP. MSMEs are also key players in the export market, making up 40% of India’s total exports.

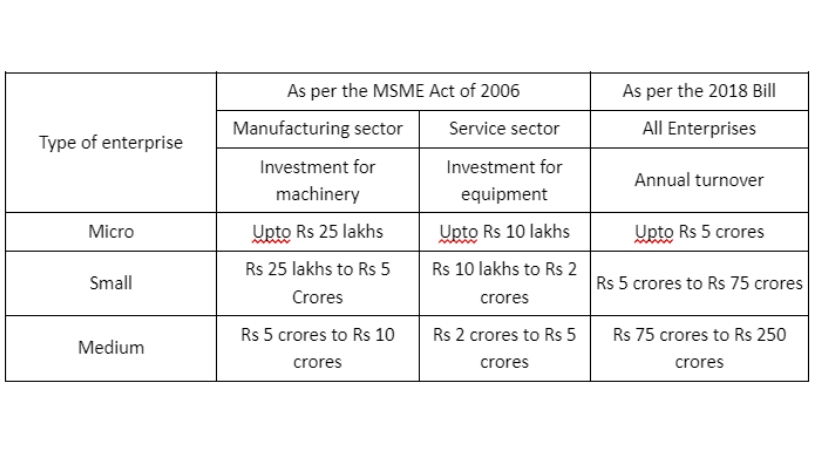

The government of India recognized the importance of MSMEs and introduced the MSME Development Act in 2006, formally defining these enterprises and establishing clear guidelines. Before this, they were simply known as small and medium-scale industries, with no clear criteria for classification. Today, MSMEs are a vital force in India’s economic landscape, driving growth and innovation across various sectors.

MSME Loans: Fueling Business Growth

One of the key challenges for MSMEs is securing adequate funding. Whether it’s for expanding operations, purchasing new equipment, or managing day-to-day expenses, loans are often necessary. Luckily, there are many lenders in the market offering loans specifically tailored for MSMEs.

MSME loans are available in various forms, each serving different business needs. Understanding these options can help businesses make informed decisions about which loan best suits their requirements.

Types of MSME Loans

Term Loans

These are long-term loans that businesses repay in fixed installments over a set period. Term loans are ideal for large, one-time investments such as purchasing property, machinery, or expanding a business.

Working Capital Loans

These loans are designed to cover daily operational costs like wages, inventory, and other short-term expenses. They ensure that a business can function smoothly without cash flow issues.

Equipment Financing

Equipment financing loans help MSMEs purchase or upgrade machinery and equipment necessary for their operations. These loans allow businesses to stay competitive and up-to-date with the latest technology.

Loans Under CGTMSE (Credit Guarantee Fund Trust for MSMEs)

This scheme offers loans up to ₹1 crore without the need for collateral. It is especially beneficial for new or small businesses that may not have assets to offer as security.

Cash Credit Loans

These loans give businesses access to a pre-approved credit limit that can be used for financing working capital. They are a flexible option for businesses that need to manage cash flow efficiently.

Invoice Financing (Bills Discounting)

This type of loan allows businesses to use their unpaid invoices as collateral for a short-term loan. Once the customers pay the invoices, the business repays the loan. It’s a great way to maintain cash flow while waiting for payments from clients.

How to apply for MSME Loan?

The MSME loan process is simple but requires careful planning. Here’s a step-by-step guide:

Determine Loan Needs: Start by assessing your business’s financial requirements. Decide on the loan amount based on your goals—whether it’s for expanding operations, purchasing equipment, or managing working capital.

Check Eligibility: MSME loan eligibility depends on factors such as business tenure, annual turnover, and credit score. Ensure your business meets the lender’s criteria before proceeding.

Prepare Documentation: Gather all necessary documents, including proof of business registration (GST certificate, Udyam registration), financial statements (balance sheet, profit and loss account), and KYC documents (identity and address proof).

Research Lenders: Compare different lenders such as banks, NBFCs, and government schemes. Pay attention to interest rates, loan terms, and lender reputation. You can use an EMI calculator to estimate your monthly payments.

Submit Application: Once you’ve selected a lender, fill out the loan application either online or in person. Attach the required documents and submit the form.

Loan Approval: The lender will review your application, and if all criteria are met, the loan will be approved and disbursed to your account.

Eligibility Criteria for MSME Loans

Different lenders have varying eligibility requirements, but some general factors are considered when evaluating MSME loan process:

Business Age

Most lenders prefer businesses that have been operational for at least 1-3 years. This demonstrates stability and a track record of managing finances.

Annual Turnover

Lenders often set minimum revenue requirements. A steady income stream is crucial, and each lender may have different turnover thresholds based on the loan amount.

Credit Score

A good credit score shows reliable financial behavior. Lenders use this to assess the risk of lending to the business. A higher credit score improves the chances of approval and may lead to better interest rates.

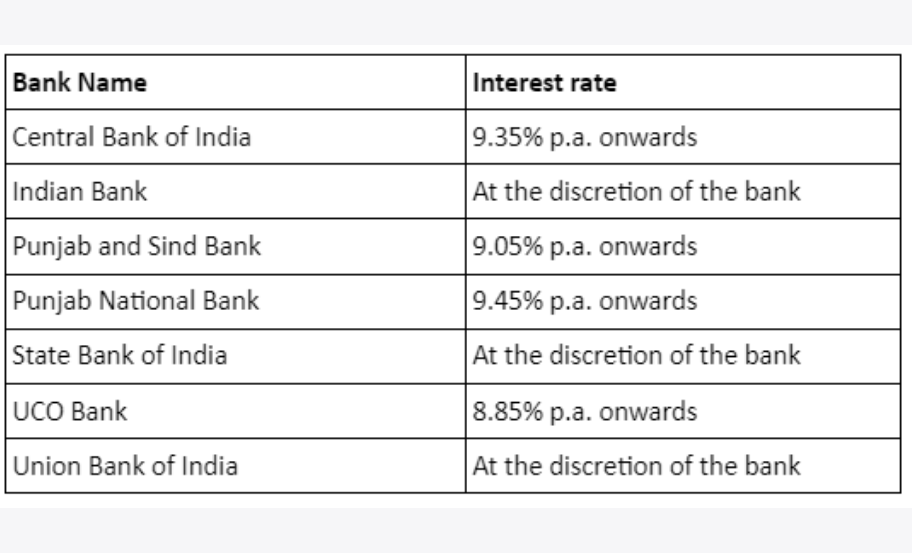

MSME Loan Interest Rates by Major Banks in 2024

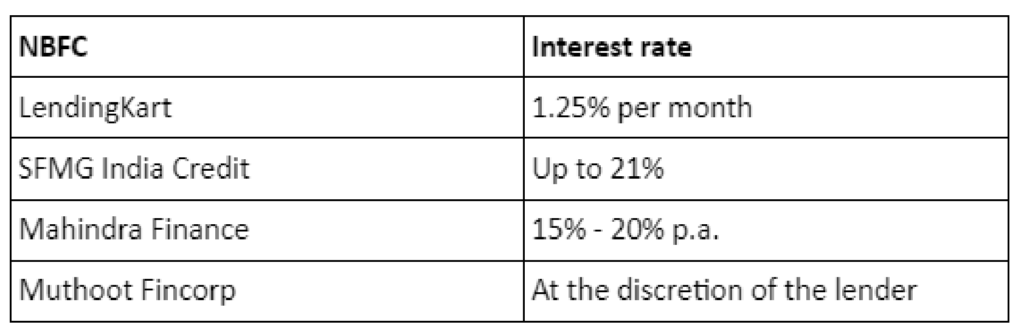

NBFCs Offering MSME Loans & Interest Rates

There are various Non-Banking Financial Companies (NBFCs) in India who offer MSME Loans to its customers at attractive interest rates. Given below are some of the NBFCs from whom you can avail an MSME Loan.

Required Documents for MSME Loan Process

Having the correct documents ready can significantly speed up the loan application process. Most lenders require:

- Business Registration Proof: Documents like the Certificate of Incorporation or GST registration are essential.

- Financial Statements: Lenders need to see recent balance sheets, profit and loss statements, and cash flow reports to assess the business’s financial health.

- KYC Documents: Identification and address proof are required for the business owner and any co-applicants.

Choosing the Right Lender

With several lending options available, finding the right lender for your business is crucial. Here are some factors to consider, if you are stuck with how to apply for MSME Loan:

Interest Rates and Terms

Compare different lenders to find the most affordable interest rates and favorable terms. Even a small difference in interest rates can lead to significant savings over time.

Reputation and Reviews

Look for lenders with a solid reputation and positive customer reviews. Reliable customer service and transparent processes are essential when dealing with loans.

Loan Flexibility

Some lenders offer more flexible loan options, including lower down payments, longer repayment periods, or tailored loan structures. Choose a lender that aligns with your business needs.

The Importance of an MSME Loan EMI Calculator

When planning to take out a loan, an EMI (Equated Monthly Installment) calculator can be a helpful tool. It allows you to experiment with different loan amounts, interest rates, and tenures to determine an affordable monthly payment.

Benefits of Using an EMI Calculator

Budget Planning

Knowing your EMI beforehand helps in planning your monthly budget. You can avoid financial stress by choosing a loan that fits comfortably within your financial capacity.

Informed Decision-Making

By using the calculator, you can try out different combinations of loan amounts and repayment terms. This helps you make informed decisions and ensures that you’re borrowing responsibly.

For instance, if a business applies for a ₹5 lakh loan at a 1.25% interest rate per month for five years, the EMI would be ₹11,122, and the total repayable amount would be ₹6.67 lakhs. Using this tool helps businesses choose the most affordable loan option.

How to Use an MSME Loan EMI Calculator

Using an EMI calculator is simple:

- Visit the lender’s website and locate the EMI calculator tool.

- Enter the desired loan amount, tenure, and interest rate.

- Click “submit” to calculate the EMI.

You can repeat this process until you find the best loan amount and EMI that suits your needs.

Conclusion

MSME loans play a critical role in helping small businesses grow and thrive. Whether it’s for purchasing new equipment, expanding operations, or simply managing day-to-day expenses, securing the right loan can make all the difference. By understanding the various loan options, following a solid MSME Loan process, and choosing the right lender, MSMEs can access the financial resources they need to succeed.

With the availability of useful tools like the MSME loans calculator, businesses can ensure that they borrow responsibly, plan their budgets, and make informed decisions that lead to long-term success.

Also Read: Empowering MSMEs through Transparent Loan Disclosures