When exporting goods from India, one of the most important documents you will need is a Commercial Invoice. This document serves as a legal record of the sale agreement between the exporter (seller) and the importer (buyer). It provides detailed information about the goods being shipped, the terms of the sale, and the financial aspects of the transaction.

Overview

A commercial invoice is a crucial document in international trade. It is prepared by the exporter and sent to the importer after the goods have been shipped. This document is used by customs authorities in both the exporting and importing countries to assess the duties and taxes that may apply to the shipment.

The commercial invoice contains essential details such as the names and addresses of the exporter and importer, a description of the goods, the quantity and price of the goods, and the terms of sale. It also includes information about the mode of transportation and the ports of loading and unloading.

Why is the Commercial Invoice Important?

The commercial invoice is important because it serves multiple purposes in the export process.

Customs Clearance: The primary purpose of the commercial invoice is to facilitate the customs clearance process. Customs officials use the information on the invoice to verify the details of the shipment and to calculate the duties and taxes that need to be paid. Without a properly completed commercial invoice, your shipment could be delayed or even denied entry into the destination country.

Legal Documentation: The commercial invoice is a legally binding document that provides proof of the agreement between the exporter and the importer. It protects both parties by clearly outlining the terms of the sale, including the price, quantity, and description of the goods. In case of any disputes, the commercial invoice can serve as evidence to resolve the issue.

Payment: The commercial invoice is also used by banks and financial institutions to process payments. It acts as a record of the transaction and helps ensure that the correct amount is paid by the importer to the exporter.

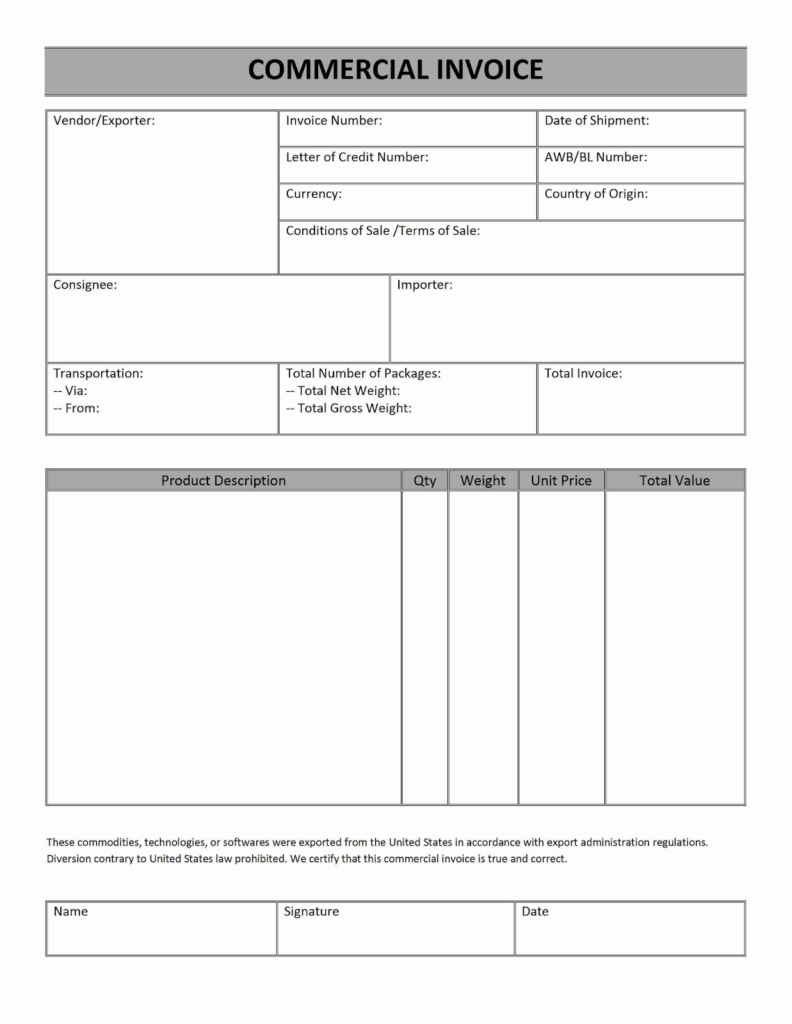

Commercial Invoice Sample Template

What Information Should Be Included in a Commercial Invoice?

A commercial invoice must include several key pieces of information to be valid and effective. Here are the essential details that should be included:

- Exporter’s company name, address, and contact number

- Importer’s company name, address, and contact details

- Buyer’s details if they are not essentially a consignee

- Mode of dispatch (whether by road, rail, air, or sea)

- Type of shipment (FCL, LCL, breakbulk, etc)

- Types of Containers (Reefer Container, TEU containers, Insulated Containers, etc)

- Vessel name and voyage number

- Names of the loading port, discharge port, and destination

- Invoice number and date

- Reference number of the Shipping BL document, Marine cover policy number, The LC, Reference number of the Air way bill document [If applicable]

- Name of country of origin of the goods

- Destination of the goods

- Terms/method of payment (optional)

How to Prepare a Commercial Invoice for Export from India?

Preparing a commercial invoice for export from India involves careful attention to detail. Here are the steps you should follow:

Use a Template: While there is no standard format for a commercial invoice, using a template can help ensure that you include all the necessary information. You can find templates online or use software tools designed for export documentation.

Fill in the Details: Enter all the required details, including the exporter’s and importer’s information, a detailed description of the goods, the terms of sale, and the shipping details. Be sure to include the HSN code for the goods, as this will be required for customs clearance.

Review for Accuracy: Before finalizing the invoice, review it carefully to ensure that all the information is accurate and complete. Any errors or omissions could lead to delays in the customs clearance process or even fines.

Sign and Date the Invoice: Once you have filled in all the details, sign and date the invoice. This adds a layer of authenticity and confirms that the information provided is accurate.

Provide Copies: Make sure to provide copies of the commercial invoice to all relevant parties, including the importer, the shipping company, the customs authorities, and your bank.

Commercial Invoice vs. Proforma Invoice

It’s important to understand the difference between a commercial invoice and a proforma invoice.

Proforma Invoice: This is a preliminary bill of sale that is provided to the buyer before the goods are shipped. It outlines the terms of the sale, including the price and description of the goods, but it does not demand payment. The proforma invoice is often used to apply for an import license or to secure financing.

Commercial Invoice: The commercial invoice, on the other hand, is issued after the goods have been shipped. It is a final invoice that demands payment and includes all the details necessary for customs clearance and payment processing.

Commercial Invoice vs. Tax Invoice

Another common question is the difference between a commercial invoice and a tax invoice.

Tax Invoice: A tax invoice is used for domestic transactions within India. It includes details about the goods or services provided and the taxes that apply to the transaction, such as GST (Goods and Services Tax).

Commercial Invoice: In contrast, a commercial invoice is used for international transactions and does not typically include local taxes like GST. Instead, it focuses on providing the information needed for customs clearance and international payment.

Commercial Invoice vs. Customs Invoice

A customs invoice is a specific type of commercial invoice that is required by the customs authorities in the importing country. It includes additional information that is not typically required on a standard commercial invoice, such as the reason for the export and a declaration that the goods comply with the regulations of the importing country.

Conclusion

In conclusion, a commercial invoice is an essential document for exporting goods from India. It serves as a legal record of the transaction, facilitates customs clearance, and ensures that the correct payment is made. By understanding the importance of this document and taking the time to prepare it accurately, you can help ensure a smooth and successful export process.