Get immediate Working Capital on upto 95% of the Invoice Value

Ready to Take Your Business to the Next Level?

Get hassle free financing for your business

Experience a game-changing approach to supply chain financing with Credlix!

We enable tailored financing solutions powered by cutting-edge tech and an extensive lending network for your business.

Export Factoring

Avail non-recourse factoring upto 90% of Invoice value for buyers in 90+ countries from Credlix upto 120 days

PO Finance

Avail financing against confirmed purchase orders from Credlix. Both domestic & export orders (upto 90 days).

Sales Bill Discounting

Avail financing against your domestic sales to Buyers (preferably large customers) upto 120 days.

Early Payment

For Anchor customers, avail vendor financing solution tailor made for your business.

Empowering Businesses to Reach New Heights: Factoring, the Superior Alternative to Loans

Providing businesses with immediate access to cash by leveraging their accounts receivable.

From Local Roots To Global Expansion

Credlix Empowers MSME Growth

75,000 +

Invoice Funded

5000 +

MSMEs Onboarded

$500 mn+

Disbursed

120 +

Cities Coverage

Tailored Capital Solutions for Your Business

Credlix automates financing, letting you focus on what matters most - your business.

40 Cr. Funds upto in 48 Hours

Zero Collateral needed

Working capital Upto 90% of Invoice

Manage Multiple Credit Lines

Hassle Free Process

Secure & Reliable

Ready to Take Your Business to the Next Level?

Get hassle free financing for your business

We are backed by global investors

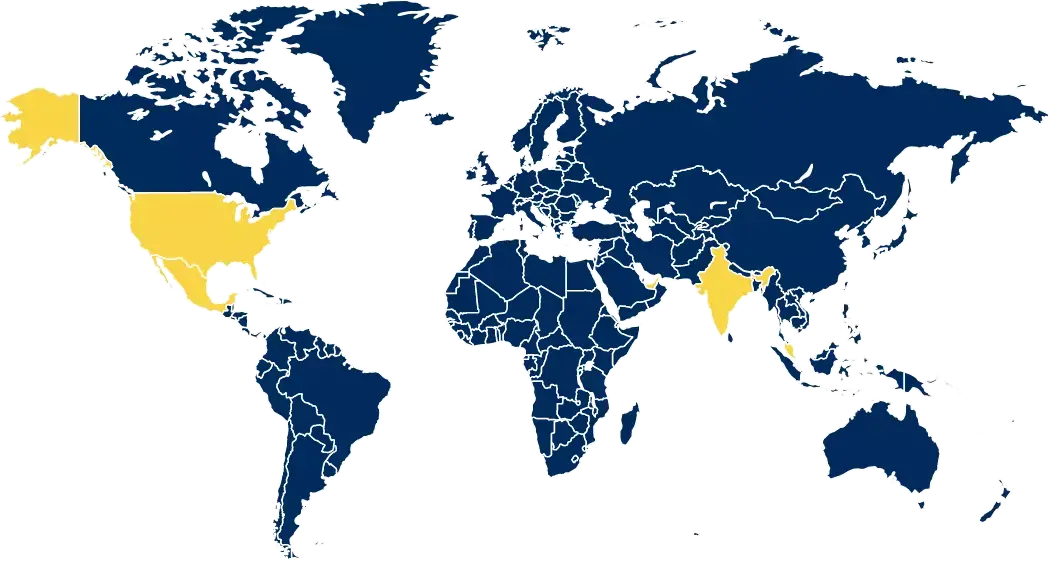

Our Global Network

Enable Faster Results

With offices in India, USA, UAE, and Mexico regions, Credlix offers localized support and expertise to clients worldwide.

India

India Mexico

Mexico Singapore

Singapore USA

USA UAE

UAE

Why Choose Credlix?

Expertise in Supply Chain Financing

As part of the Moglix Group, we leverage deep industry insights and a robust network.

Global Reach

With offices in India, USA, UAE, and Mexico, and partnerships in 90 countries, we support your global trade needs.

Apply Today to unlock the value of your invoices and propel your business growth with Credlix.

Credibility You Can Trust

Backed by industry recognition

Our Happy Clients

What they say about us

FAQs

What is Supply Chain Finance?

What are the Documents Required for Supply Chain Finance?

What are the Types of trading services offered under Supply Chain Finance?

What is the Eligibility Criteria for Supply Chain Finance?

What is the Interest Rates for Supply Chain Finance?

How can one apply for Supply Chain Finance?

What are the Features & Benefits of Supply Chain Finance?

Who all can avail Supply Chain Finance?

What is the repayment tenor of supply chain finance?

What are the types of SME loans for supply chain finance?

How is the interest rate calculated and finalized by the company providing supply chain finance?

How many limits can a business avail from supply chain finance?