Cross-border trade plays an important role in driving the global economy forward, yet it introduces uncertainties and risks, particularly impacting importers and exporters. Importers often face the challenge of securing funds to purchase products from overseas, while exporters grapple with the uncertainty of receiving timely payments from international buyers.

In response to these challenges, international trade finance emerges as a crucial mechanism aimed at mitigating risks for all stakeholders involved in global trade. By providing monetary support and assurance, trade finance mechanisms seek to minimize risks associated with cross-border transactions.

Understanding the workings and types of international trade finance is essential for businesses to navigate the complexities of global trade effectively and ensure smooth transactions across international boundaries.

What is International Trade Finance?

International trade finance means banks or financial institutions provide support to importers and exporters. They use tools like bank guarantees and letters of credit to help these businesses carry out transactions smoothly without facing money problems. This assistance ensures that buying and selling goods across borders is easier and helps businesses avoid financial difficulties during the process.

What all Parties are Involved in International Trade Finance?

Several parties are involved in international trade finance to facilitate smooth transactions across borders. These parties include:

Importers: Businesses or individuals who purchase goods or services from foreign countries.

Exporters: Businesses or individuals who sell goods or services to foreign countries.

Banks: Financial institutions that provide various trade finance services, such as issuing letters of credit, providing financing, and managing payments between importers and exporters.

Export Credit Agencies (ECAs): Government agencies that provide insurance, guarantees, and financing to support exports from their respective countries.

Freight Forwarders: Companies that arrange the transportation of goods from the exporter’s location to the importer’s location.

Insurers: Insurance companies that offer policies to protect against risks such as non-payment, damage to goods during transit, or political instability in the importing country.

Customs Authorities: Government agencies responsible for regulating and overseeing the import and export of goods, including enforcing trade regulations and collecting duties and taxes.

By working together, these parties help facilitate international trade by providing financial support, managing risks, and ensuring the smooth movement of goods across borders.

How International Trade Finance Works?

International trade finance operates through a series of interconnected processes and financial instruments designed to facilitate cross-border transactions. Here’s an overview of how it works:

Agreement Negotiation: The buyer and seller negotiate the terms of the trade agreement, including pricing, delivery terms, and payment conditions.

Financing Request: The exporter may require financing to fulfill the order or cover production costs. They may approach a bank or financial institution to request trade finance assistance.

Financial Instrument Issuance: Upon approval of the financing request, the bank issues a financial instrument such as a letter of credit (LC), bank guarantee, or documentary collection to provide assurance to the parties involved.

Shipment and Documentation: The exporter ships the goods according to the terms of the agreement and prepares the necessary documentation, including invoices, packing lists, and certificates of origin.

Presentation of Documents: The exporter submits the shipping documents to their bank, which verifies their compliance with the terms of the financial instrument.

Payment or Financing: Depending on the type of financial instrument used, payment may be made directly to the exporter, or the bank may provide financing against the presented documents.

Receipt of Goods: The buyer receives the goods and may inspect them to ensure they meet the agreed-upon specifications.

Repayment or Settlement: The buyer repays the financing provided by the bank, either immediately or according to the agreed-upon payment terms.

Risk Mitigation: Throughout the process, various risks such as non-payment, currency fluctuations, and political instability are mitigated through the use of trade finance instruments and insurance.

Completion of Transaction: Once all parties have fulfilled their obligations and the transaction is completed, the trade finance process concludes.

Overall, international trade finance streamlines cross-border transactions, mitigates risks, and provides the necessary financial support to facilitate global trade effectively. By leveraging a combination of financial instruments and expertise, businesses can navigate the complexities of international trade with confidence and efficiency.

Who Uses International Trade finance?

International trade finance is utilized by a diverse range of entities including importers, exporters, traders, producers, and manufacturers. Importers rely on trade finance to secure funds for purchasing goods from foreign markets, while exporters use it to ensure timely payment and manage financial risks associated with cross-border transactions.

Traders and manufacturers also benefit from trade finance by accessing financing options to support their international trade activities, ultimately facilitating smoother transactions and fostering global business growth.

Who Provides Trade Finance?

Trade finance services are provided by a variety of financial entities beyond banks, ensuring reliable support for import and export activities. Financial institutions offer a wide range of financial products, including investments and loans, catering to corporate clients’ diverse needs.

Additionally, financial intermediaries, such as agents and third-party service providers, collaborate with financial corporations to facilitate foreign trade transactions. This includes insurance brokers who connect businesses with insurance companies. Traditional commercial banks, regardless of size or location, extend international trade finance services to businesses globally, supporting their cross-border operations.

What Makes International Trade Finance Different from Others?

International trade finance differs from other financing options in several key ways:

Global Scope: International trade finance specifically caters to businesses engaged in cross-border trade, facilitating transactions between parties located in different countries. In contrast, other financing options may focus primarily on domestic transactions.

Risk Management: Trade finance often involves managing risks associated with international trade, such as currency fluctuations, political instability, and payment default. Financing options like traditional loans or lines of credit may not offer the same level of risk mitigation tailored to international trade.

Specialized Products: Trade finance offers specialized products tailored to the unique needs of importers and exporters, such as letters of credit, trade credit insurance, and export financing. These products address specific challenges encountered in international trade, providing customized solutions not typically found in other financing options.

Documentation Requirements: International trade finance often requires extensive documentation to ensure compliance with trade regulations and mitigate risks. This includes documents such as letters of credit, bills of lading, and export/import licenses, which are not typically required for other financing options.

Currency Management: International trade finance involves managing currency exchange risks inherent in cross-border transactions. Financing options may offer currency hedging or other tools to manage currency risk, but they may not be as specialized or integrated into the financing process as they are in trade finance.

Overall, international trade finance provides a comprehensive suite of services and products specifically designed to support businesses engaged in global trade, offering tailored solutions to address the unique challenges and opportunities of cross-border transactions.

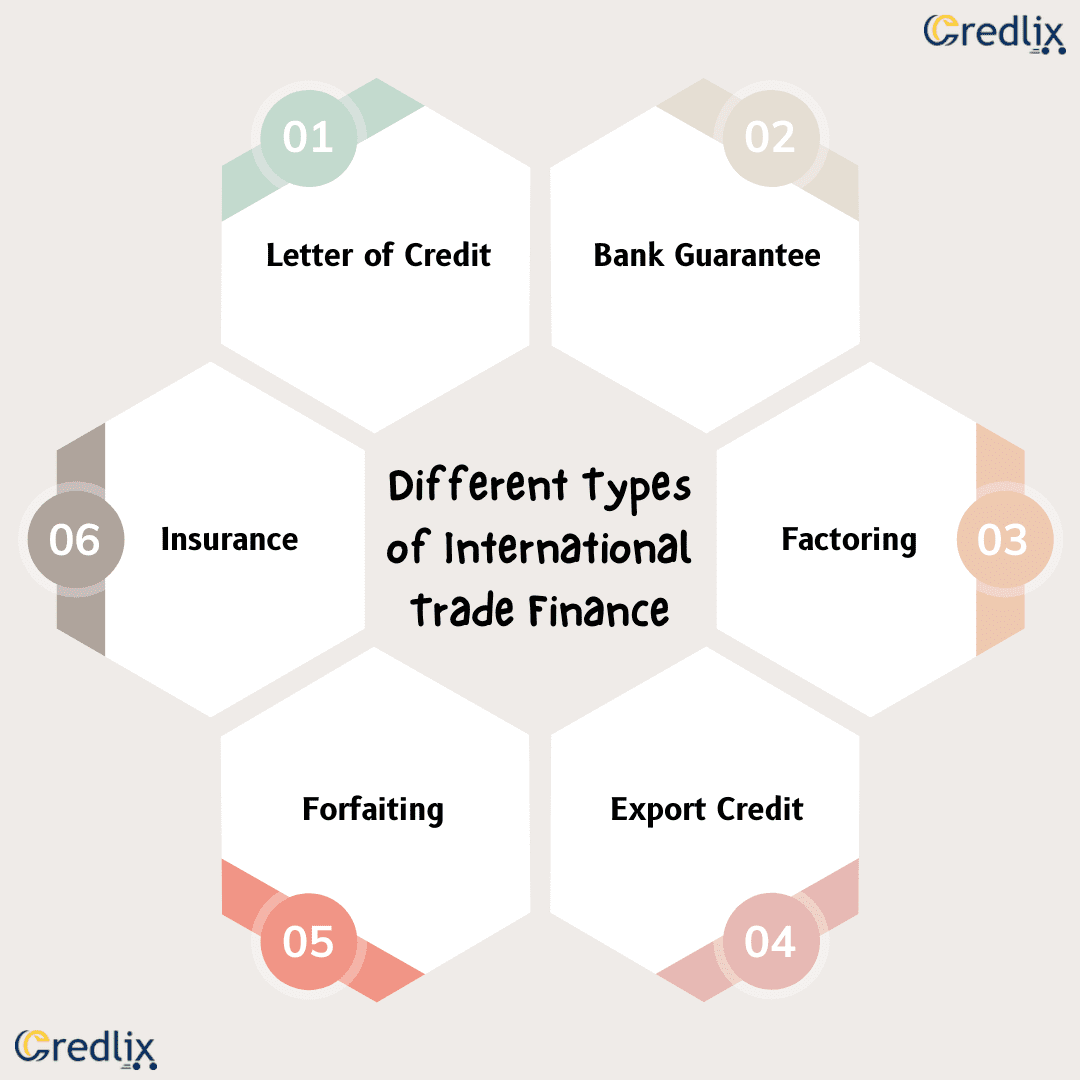

Different Types of International Trade Finance

The following are the different types of International trade finance:

Letter of Credit

A letter of credit (LC) is a crucial document in international trade, issued by a bank on behalf of a buyer to reassure the seller that payment will be made promptly upon delivery of goods or services. It confirms the availability of funds and acts as a guarantee for the seller.

When the seller fulfills the terms and conditions outlined in the LC, the bank pays them either partially or in full. Importantly, the buyer cannot access the funds directly; instead, they are reserved by the bank until the transaction is completed satisfactorily. This arrangement provides security for both parties, ensuring that the seller receives payment and the buyer receives the goods or services as agreed upon.

Bank Guarantee

International businesses, regardless of size or location, can access international trade finance services from both domestic and foreign banks. One essential aspect of trade finance offered by banks is the provision of bank guarantees. These guarantees serve as a form of security in case the importer or exporter fails to fulfill their contractual obligations. Essentially, if one party cannot uphold their end of the agreement, the bank steps in to ensure compensation or performance.

This assurance allows businesses involved in cross-border trade to seek financial assistance confidently, knowing that their transactions are backed by the reliability and credibility of the banking institution. Bank guarantees provide a vital safety net, fostering trust and enabling smoother international trade transactions for businesses worldwide.

Factoring

Factoring serves as a valuable financial solution for businesses requiring quick access to cash. It involves selling accounts receivable to a third-party entity, called a factor, at a discounted rate. In this arrangement, the factor advances funds to the business against the value of its outstanding invoices. The factor then assumes responsibility for collecting payments from the business’s customers or clients. Once the payments are received, the factor deducts its fee and forwards the remaining amount to the business.

Factoring enables businesses to convert their unpaid invoices into immediate cash flow, providing liquidity to support ongoing operations and growth initiatives. This flexible financing option offers businesses a practical way to manage cash flow challenges and maintain financial stability.

Export Credit

Export credit is a financial tool that allows foreign buyers to defer payment for goods or services purchased from companies operating overseas. This credit can take the form of guarantees, insurance, or extended credit terms, providing flexibility in payment arrangements. Typically facilitated by export credit agencies, businesses engaged in international trade can access these financial services to support their export activities.

Export credit agencies play a crucial role in mitigating risks associated with cross-border transactions, ensuring that both exporters and foreign buyers can engage in trade with confidence. By offering guarantees and insurance, export credit agencies enable businesses to expand their global reach and facilitate trade relationships across international boundaries, fostering economic growth and prosperity.

Forfaiting

Forfaiting is a financial practice where exporters sell their accounts receivable to a forfaiter at a discounted rate in exchange for immediate cash. Essentially, the exporter forgoes future payments by transferring the rights to their export receivables to the forfaiter without any recourse. In this arrangement, the forfaiter assumes the risk of non-payment from the importer, providing the exporter with upfront cash flow.

By selling these future receivables at a reduced price, exporters can secure immediate liquidity to support their operations and growth initiatives. Forfaiting offers a valuable solution for businesses engaged in international trade, enabling them to manage cash flow effectively and mitigate risks associated with delayed payments from overseas buyers.

Insurance

Insurance is a critical component of international trade, offering protection against common risks such as cargo loss, damage to goods, and non-payment from buyers. These risks can significantly affect exporters, jeopardizing their financial stability and business operations. By securing appropriate insurance coverage, exporters can mitigate the potential financial losses associated with unforeseen events during the shipping and delivery process.

Insurance not only provides peace of mind but also serves as a safeguard, ensuring that exporters can confidently engage in global trade without worrying about the potential impact of adverse events. With insurance coverage in place, exporters can focus on growing their businesses and expanding their international market reach, knowing that they are adequately protected against various risks inherent in cross-border trade.

10 Major Benefits of International Trade Finance

Here are ten major advantages of international trade finance:

Enhanced Cash Flow: Trade finance provides access to immediate funds, improving cash flow and enabling businesses to meet operational expenses and invest in growth initiatives.

Risk Mitigation: Trade finance mechanisms, such as letters of credit and trade credit insurance, help mitigate risks associated with non-payment, currency fluctuations, and political instability, safeguarding businesses against financial losses.

Improved Liquidity: By leveraging trade finance solutions like factoring and forfaiting, businesses can convert accounts receivable into cash, enhancing liquidity and supporting ongoing operations.

Expansion Opportunities: Trade finance facilitates access to international markets, enabling businesses to explore new opportunities for growth and expansion beyond domestic borders.

Competitive Advantage: With access to trade finance, businesses can offer competitive payment terms to customers, attracting new clients and gaining a competitive edge in the global marketplace.

Working Capital Optimization: Trade finance tools, such as supply chain financing, help optimize working capital by extending payment terms to suppliers and improving inventory management.

Flexibility in Financing: Trade finance offers flexible financing options tailored to the unique needs of businesses engaged in international trade, providing customized solutions to address specific challenges and opportunities.

Regulatory Compliance: Trade finance professionals possess expertise in navigating complex international trade regulations, ensuring compliance with legal requirements and minimizing the risk of penalties or fines.

Relationship Building: Trade finance fosters strong relationships between businesses, banks, and other stakeholders involved in global trade, facilitating trust and collaboration across international borders.

Economic Growth: By facilitating cross-border transactions and supporting international trade activities, trade finance contributes to economic growth, job creation, and poverty reduction on a global scale.

International trade finance acts as the backbone of global trade, offering crucial financial support and risk mitigation for businesses operating across borders. By providing funds, managing risks, and fostering trade relationships, trade finance ensures smooth transactions and promotes economic growth on a global scale. Understanding its mechanisms and benefits is essential for businesses to thrive in the international marketplace.

Also Read: Types Of Trade Finance Products: Financing Foreign Trade